Banks pursue the ‘underbanked’: millennial and low-income clients

New York City’s status as a global banking capital hasn’t helped it solve a vexing challenge: a large population of people who are “underbanked” and have limited access to financial services—or have no bank at all.

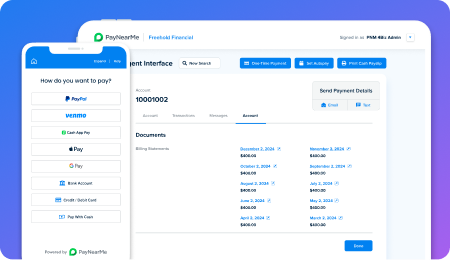

Meanwhile, PayNearMe, an electronic cash-transaction network, recently partnered with nonprofit microlender Grameen America to let its borrowers repay their debts in cash at 7,800 7-Eleven stores, such as one in Sunset Park, Brooklyn, a location convenient to many city members of Grameen. About 2,600 New Yorkers in Grameen’s network will be eligible, said Danny Shader, CEO of PayNearMe, based in the San Francisco area.