An Introduction to Payments Optimization

Do you still think of payments as a cost center—a conversation that begins and ends with interchange and ACH rates?

This way of thinking has dominated payments buying decisions for years, and with good reason. For decades, most payment software acted as a simple gateway—a necessary but costly intermediary between you and your money. That is, until bill pay software caught up with the rest of the industry.

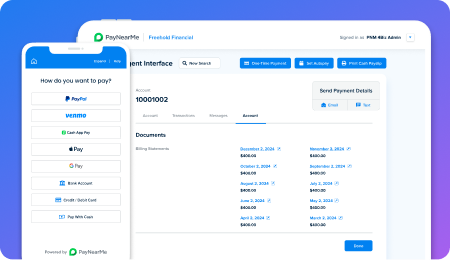

Modern bill pay platforms (like PayNearMe) are changing the relationship between lenders and their payments technology. Instead of adding a cost to each transaction, smart bill pay software can now help you optimize your payments mix, helping you to drive up on-time payments, increase operational efficiency and drive down the total cost of accepting payments.

Rethinking the Role of Payments Technology as a Profit Driver

Before you call shenanigans, let’s address the elephant in the room: there are still real, hard costs associated with accepting payments. Software providers, card networks and other members of the value chain still charge fees for access, most of which come on a per transaction basis. But the right payments software can negate many of these costs by driving down the total cost of accepting payments and increasing margins.

In our recent webinar “How to Optimize Your Payments to Improve Profitability“, we introduced the concept of payments optimization in lending, and shared several ways you can use platforms like PayNearMe to increase efficiency.

Below is a quick recap to get you started. Alternatively, you can watch the full webinar on-demand at your leisure.

What is Payments Optimization?

At its core, payments optimization focuses on streamlining the way you accept, process and manage your payments. Payments optimization starts by identify time consuming, cumbersome and expensive processes that drive up the total cost of accepting payments.

There are many situations where payments optimization can be a useful exercise for lenders. For example, imagine:

- …a subprime lender serving a large proportion of unbanked and underbanked customers that receives 20-25% of payments by cash or money orders, with staff spending inordinate amounts of time collecting, securing and transporting these payments to the bank.

- …a fully staffed call center taking payments over the phone, with call time averaging 8 minutes per customer and creating bottlenecks during peak collection times.

- …an in-house accounting team that has to manually reconcile several daily deposit files from multiple vendors, while separately matching additional files for chargebacks, cash payments and refunds, taking hours per day.

- …a customer service team that spends more time fielding calls about password resets or payment reminders than resolving difficult, high-touch customer interactions.

A focus on payments optimization can help solve for these and other challenges when done correctly.

Four Techniques to Consider

While there are many ways to implement payments optimization, here are four practical approaches for lenders to get started.

Reduce your “time to collect” per payment

The less time and manpower spent collecting each payment, the lower your total cost of acceptance. Find ways to reduce employee involvement in accepting payments, and enable to customers to self-serve whenever possible.

Examples include:

- Enable on-time customers to make payments without interacting with your business

- Redirect cash payments to retail locations

- Train agents to push payment links (via SMS or email) to help customers learn how to self-serve

- Use IVR as the first-touch on your main phone number, allowing automated payments for those who don’t need to speak with an agent

Optimize your payments mix

Knowing how, when and where your customers want to pay can help you improve the likelihood of getting paid on-time. Optimize your payments mix to meet the needs of all your customers, giving them more ways to pay.

Examples include:

- Offer more payment types that appeal to different customer segments, such as cash, cards, Venmo, Apple Pay and others

- If you charge convenience fees, charge lower (or no) fees for self-service activities such as online payments

- Train staff to encourage payments that are more beneficial to your business, such as recurring autopay

Automate repeatable tasks

Back-office activities surrounding payments can put a big strain on staff. When possible, use logic-based business rules to automate compliance, risk and accounting related tasks that would otherwise require manual intervention.

Examples include:

- Flag customers with repeat exceptions (i.e. customers that NSF multiple times per year) and restricting them to guaranteed payment types

- Use digital disbursements to streamline approvals and automate payouts

- Configure daily reports to be sent at the same time each day in the same format to reduce manual reformatting

Consolidate your technology

Your payments processes are only as strong as the weakest link in your tech stack. Reducing the total number of vendors you manage can have a variety of benefits for your business.

Examples include:

- Create a consistent user experience across all payment types and channels

- Reduce the number of invoices and integrations needed for discrete point solutions (i.e. SMS, ebill, wallets)

- Integrate with your system of record / LMS / DMS for simplified data sharing

- Simplify reconciliation with a single file for all payments

Getting Started with Payments Optimization

While this post shared key insights into ways you can optimize your payments, we cover quite a bit more during the webinar. To hear the full discussion and learn how PayNearMe current clients are leveraging our payments technology to streamline and optimize their payments stack, view our on-demand webinar here.

To see how PayNearMe can help you optimize your payments to improve efficiency and profitability, schedule a Zoom call with one of our experts today.